As the Indian economy pivots toward innovation and infrastructure in 2025, Alternative Investment Funds (AIFs) are increasingly redirecting capital into sectors with long-term growth potential. With assets under management (AUM) crossing ₹10 lakh crore, AIFs are no longer niche—they’re shaping the future of wealth allocation. If you’re looking to diversify your portfolio beyond traditional equity and mutual funds, here’s where the smart money is heading.

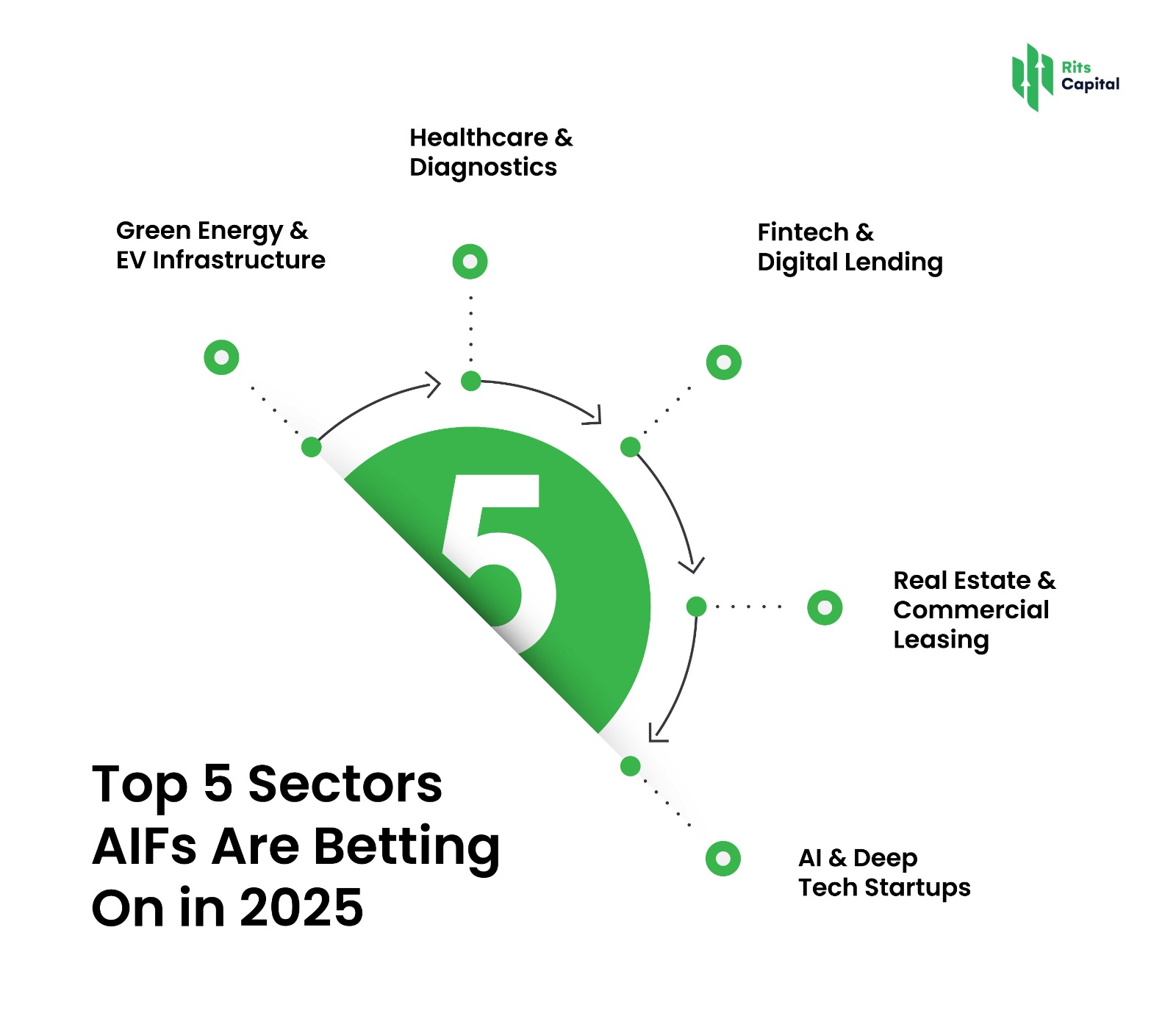

Below are the top 5 sectors AIFs are betting on in 2025, along with key insights into why these sectors are in focus.

1. Green Energy & EV Infrastructure

Why It’s Booming:

India’s goal to become net-zero by 2070 and aggressive EV adoption targets are pushing massive investments in clean energy, solar grids, and EV charging stations. AIFs, especially Category II infrastructure-focused funds, are channeling capital into:

- Renewable power generation (solar, wind)

- Battery storage technologies

- EV logistics and mobility startups

High-volume keywords: green energy investment in India, EV infrastructure funding, AIF renewable energy

Notable Developments:

- ₹50,000 crore earmarked for green hydrogen and solar parks in Union Budget 2025

- Government subsidies attracting global EV players

Read about private equity & infrastructure opportunities on Rits Capital

Investopedia on renewable energy investing

2. Healthcare & Diagnostics

Why It’s Booming:

Post-COVID awareness and digital health penetration have led to a structural shift. AIFs are now focusing on:

- Diagnostic chains

- Healthtech platforms

- Hospital and medical device expansions

India’s growing middle class is driving demand for affordable, quality healthcare—an ideal space for long-term private capital infusion.

High-volume keywords: healthcare AIFs in India, diagnostics investment, healthtech private equity

Market Insight:

- Diagnostic market projected to grow at 11% CAGR till 2030

- Ayushman Bharat and PLI schemes for medical devices fueling growth

Explore unlisted healthcare investments

Wikipedia on HealthTech

3. Fintech & Digital Lending

Why It’s Booming:

With UPI transactions crossing ₹20 lakh crore per month, India is a global fintech leader. AIFs are investing in:

- NBFCs and neo-banks

- Digital lending startups

- Payment gateway technologies

Category I and II AIFs are particularly bullish on private debt models and revenue-based financing in this space.

High-volume keywords: fintech AIF investments, digital lending India 2025, NBFC growth

Sector Snapshot:

- 100+ fintech unicorns expected by 2026

- RBI’s regulatory sandbox aiding innovation

4. Real Estate & Commercial Leasing

Why It’s Booming:

Thanks to REITs and rental yield models, commercial real estate is back in vogue. AIFs are funding:

- Co-working spaces

- Grade-A office leasing

- Warehousing and logistics parks

Private credit AIFs are also backing structured debt deals in metro city real estate.

High-volume keywords: commercial real estate AIFs, warehousing investment, REIT vs AIF

Key Drivers:

- IT and BFSI sectors expanding office demand

- E-commerce boom boosting warehouse requirements

5. AI & Deep Tech Startups

Why It’s Booming:

India’s emerging status as a global AI hub is catching the eye of venture-focused AIFs. From generative AI to drone tech and cybersecurity, the deep tech revolution is AIFs’ next frontier.

High-volume keywords: AI startup funding India, deep tech investment AIF, generative AI India

Momentum Indicators:

- ₹10,000 crore fund of funds announced by DPIIT for deep tech

- Major exits and IPOs from AI-backed companies in pipeline

Why AIFs Are Chasing These Sectors

The shift from traditional investing to theme-based alternative strategies is driven by:

- Flexibility in asset allocation

- High alpha potential

- Access to private markets and pre-IPO companies

AIFs provide tailored investment vehicles beyond conventional listed assets—suitable for HNIs and family offices seeking portfolio diversification and long-term growth.

Final Thoughts

In 2025, Alternative Investment Funds are no longer playing safe—they’re placing strategic bets on sectors that define India’s next decade. Whether it’s clean energy, fintech, healthcare, or AI, AIFs are blending risk with vision.

Thinking of accessing these high-growth sectors?

Talk to Rits Capital to explore AIF opportunities curated for your financial goals.

FAQs

1. What is an AIF and who can invest in it?

Ans: An AIF is a privately pooled investment vehicle. Typically, HNIs, family offices, and institutional investors invest in AIFs. Learn more

2. Are AIFs better than mutual funds in 2025?

Ans: If you’re seeking custom strategies, private equity, or debt exposure, AIFs offer higher flexibility—but also come with higher risks and minimum investment of ₹1 crore.

3. How are AIFs taxed in India?

Ans: Category I and II AIFs enjoy pass-through status; however, Category III is taxed at fund-level. Gains are taxed based on the asset class involved.

4. Can AIFs invest in startups and unlisted companies?

Ans: Yes. Especially Category I (venture capital funds) and Category II AIFs focus on early-stage, growth-stage, and unlisted opportunities.

5. How can I apply for an AIF in India?

Ans: You can invest in AIFs via SEBI-registered advisors or wealth management firms like Rits Capital, where we assist with due diligence, documentation, and fund matching