Public Sector Undertakings (PSUs) have been on a spectacular run over the last two years. From defence to energy to railways, these once-ignored government-backed companies are now darlings of both retail and institutional investors. But the big question that investors are asking in 2025 is — will PSU stocks continue their bull run this year?

Let’s dive into the macroeconomics, government policy tailwinds, valuation metrics, and sectoral dynamics to understand if there’s still juice left in the PSU rally — or if the party is close to winding down.

A Look Back: What Triggered the PSU Rally?

Until 2021, PSU stocks were often dismissed as slow movers — plagued with inefficiencies, overregulation, and political interference. Fast forward to 2023 and 2024, and the story flipped:

- BSE PSU Index surged over 100% in 24 months.

- Stocks like BEL, HAL, IRFC, and Coal India touched all-time highs.

- Retail participation in PSU stocks hit record levels.

So, what changed?

Government-Led Reform Momentum

The Modi government pushed hard on “Minimum Government, Maximum Governance,” leading to:

- Disinvestment and IPOs of PSU companies (LIC, IRFC, Mazagon Dock).

- Focus on self-reliance (Atmanirbhar Bharat), especially in defence.

- Capex push in railways, infra, and energy.

- Better corporate governance and transparency in financial reporting.

All these efforts resulted in stronger fundamentals, cleaner balance sheets, and visible earnings growth — which the markets rewarded.

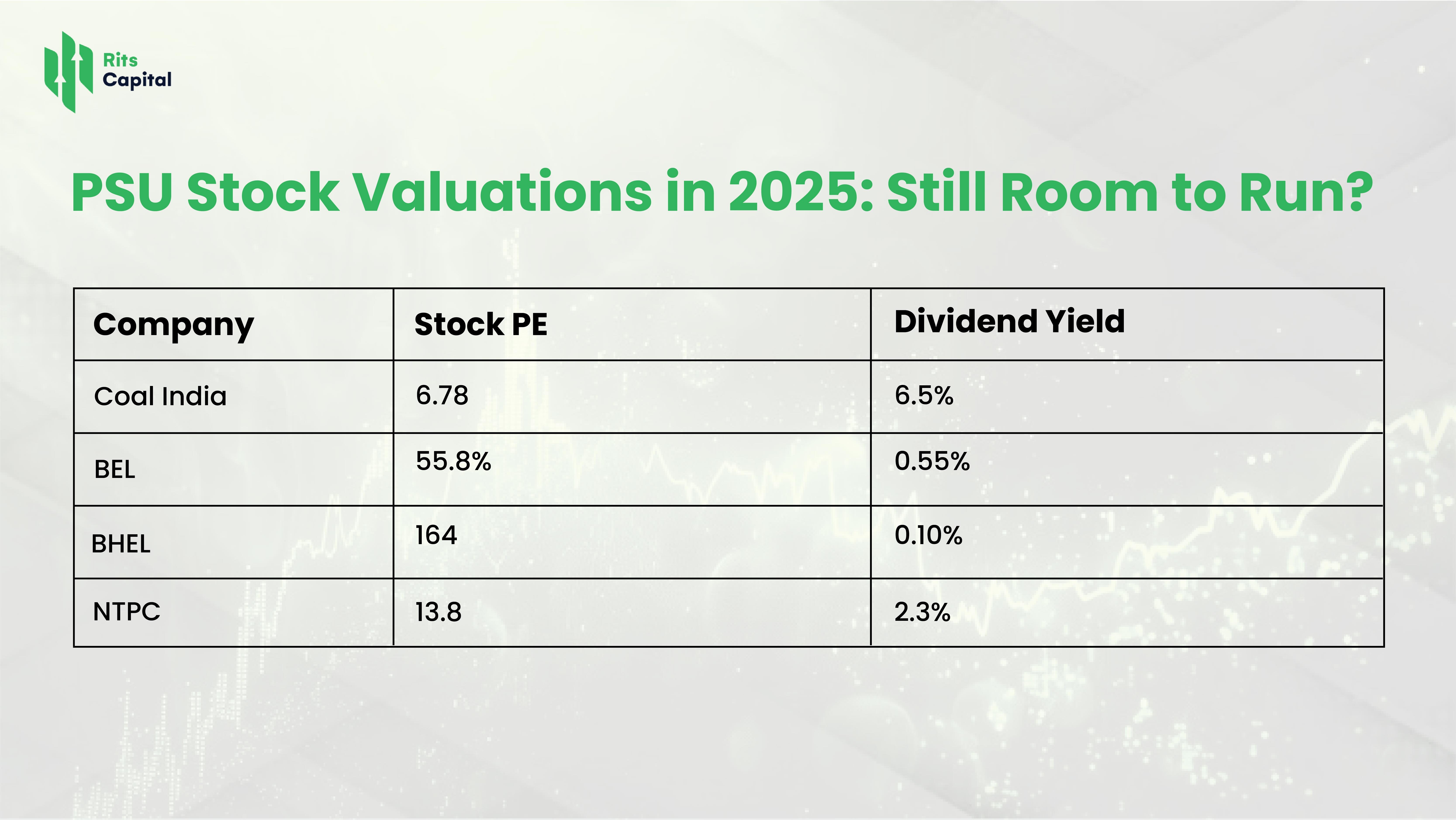

PSU Stock Valuations in 2025: Still Room to Run?

Despite the surge, many PSU stocks are still trading at attractive valuations, especially when compared to their private sector peers. Here’s a snapshot:

Compare this with private sector peers in similar sectors and you’ll often see a valuation premium of 2x or more.

Even after a strong run, PSUs remain undervalued in relative terms, making them attractive for long-term investors, especially those looking for value stocks in India.

Key Growth Sectors for PSU Stocks in 2025

Here’s where PSU stocks are still seeing momentum:

1. Defence PSU Stocks

With India pushing for indigenous defence production and increased exports, companies like BEL, HAL, and BEML are seeing strong order inflows.

Keyword opportunity: Top defence PSU stocks in India 2025

2. Railways and Infra

As capital expenditure in Indian Railways hits record levels, stocks like IRFC, RVNL, and IRCON are gaining traction.

Keyword opportunity: Best PSU railway stocks to invest in

3. Energy & Power

With India’s energy transition in focus, companies like NTPC, Power Grid, and ONGC are positioned to benefit from both conventional and renewable shifts.

Keyword opportunity: High dividend PSU energy stocks

FII & DII Participation: Big Money Flowing In

Institutional interest in PSU stocks has risen sharply:

- Foreign Institutional Investors (FIIs) have increased holdings in select PSU banks and defence stocks.

- Domestic Mutual Funds and Insurance Companies are overweight in sectors like energy, power, and transport.

This inflow signals long-term confidence in the PSU growth story.

Policy Continuity Post Elections: Key to the Rally

The 2024 general elections delivered political stability, ensuring continuity of economic policy, infrastructure spending, and privatisation efforts. Investors now expect:

- More disinvestment plans

- Increased capex in rail, defence, and digital infrastructure

- Stable interest rates and controlled inflation

All of which favour the PSU ecosystem.

What Risks Should Investors Watch?

No bull run is without caution. Here are a few red flags:

- Overheating in select PSU stocks (some have doubled or tripled in a year).

- Delays in reforms or disinvestment targets.

- Global macro shocks like rising oil prices, US Fed policy shifts, or geopolitical tensions.

- Profit booking by retail investors amid volatility.

That said, most experts believe PSU stocks still have legs — especially those with consistent cash flows, government orders, and low debt.

What Should Investors Do?

If you missed the rally, it’s not too late — but be selective. Focus on:

- Companies with strong order books (like BEL, HAL)

- Low PE ratios and high dividend yield (like Coal India, ONGC)

- Infra and capex plays with government backing (like IRFC, RVNL)

Don’t blindly chase momentum. Use tools like fundamental analysis, sector outlook, and risk-reward evaluation.

You can explore our curated research on top PSU stock opportunities for long-term investors at Rits Capital.

Also, if you’re a new investor looking to understand how economic indicators impact PSU stocks, check out our latest blog on economic indicators and portfolio strategy.

Want to Learn More?

Here are some useful external resources:

- What are PSU Stocks? – Investopedia

Final Word: PSU Stocks in 2025 — Still Bullish?

Yes, but with caution. PSU stocks are no longer the forgotten underdogs. They’ve emerged as legitimate wealth creators — backed by strong balance sheets, strategic government support, and investor interest.

The rally may not be as steep as 2023–24, but steady growth, dividends, and reforms make them attractive for value-seeking investors in 2025.

As always, diversify your portfolio, don’t get swayed by social media hype, and invest based on your risk appetite and goals.

FAQs: PSU Stocks in 2025

1. Are PSU stocks still undervalued in 2025?

Ans: Yes, many PSU stocks trade at lower PE ratios compared to private counterparts, offering a value investing opportunity.

2. Which PSU sectors are likely to outperform?

Ans: Defence, railways, power, and infrastructure sectors are expected to lead the PSU charge in 2025.

3. Is it safe to invest in PSU stocks now?

Ans: Investing in fundamentally strong PSUs with consistent performance and dividends is considered safer, but always assess your own risk appetite.

4. What are the best PSU dividend stocks in 2025?

Ans: Coal India, ONGC, and NTPC are popular among income-focused investors for their high dividend yields.

5. Where can I find research on PSU stocks?

Ans: You can explore insights and deep-dive analysis at Rits Capital’s stock insights page.